Recently, the world has seen a couple of high-profile Banks run out of money and fail.

Everyone has heard the expression that Banks are “too big to fail”, so how does his happen?

1. Poor Risk Management: Banks can fail if they take on too much Risk on their investments / lending, without proper Risk Management controls in place. This can lead to significant losses, such as the ones experienced during the 2008 financial crisis. In this case, risk controls and due diligence in the housing market were not tight enough.

2. Inadequate Capital: Banks need to have sufficient capital to absorb potential losses (a buffer if you like). If they have inadequate capital, they may not be able to absorb losses caused by macroeconomic affects or ‘bad investments’ and may be forced to close.

3. Economic downturns: Economic downturns, such as recessions, can lead to increased loan defaults and decreased demand for banking services, which can result in significant losses for Banks. If customers cant pay back their Loans (Mortgages, Credit Cards, Car Finance etc) or Companies that borrow money go bust, the movement of money stops.

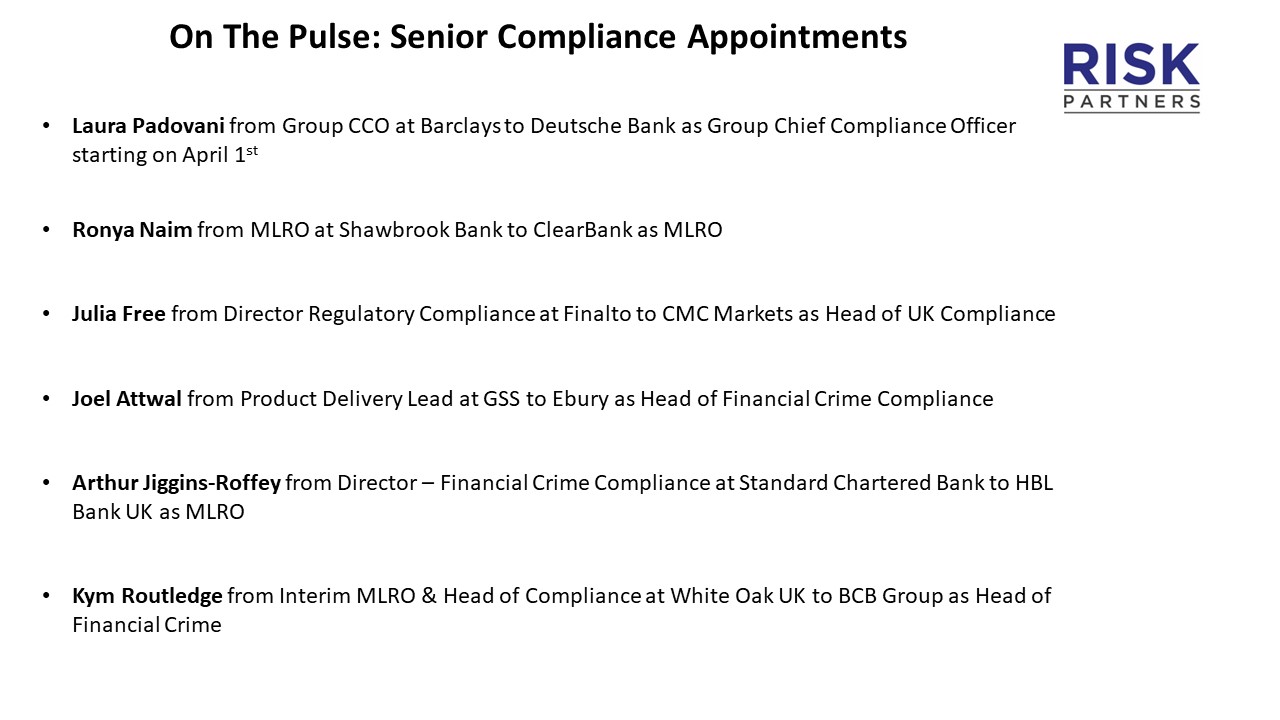

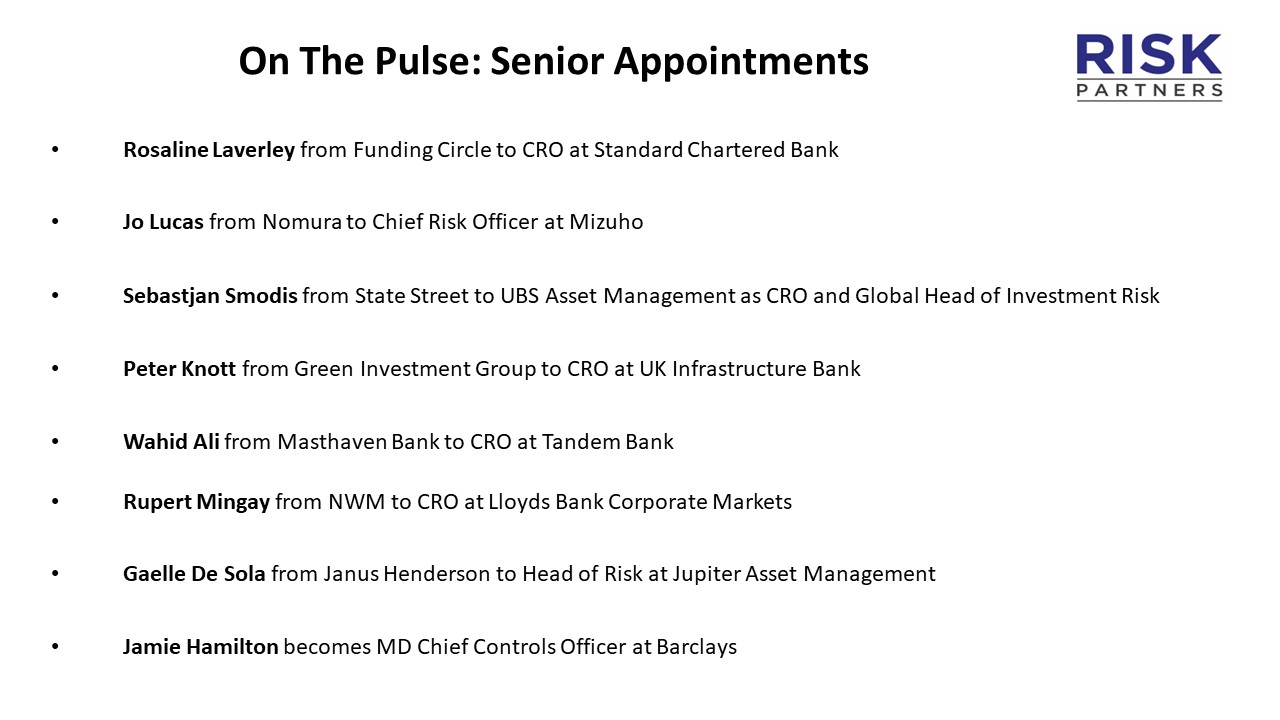

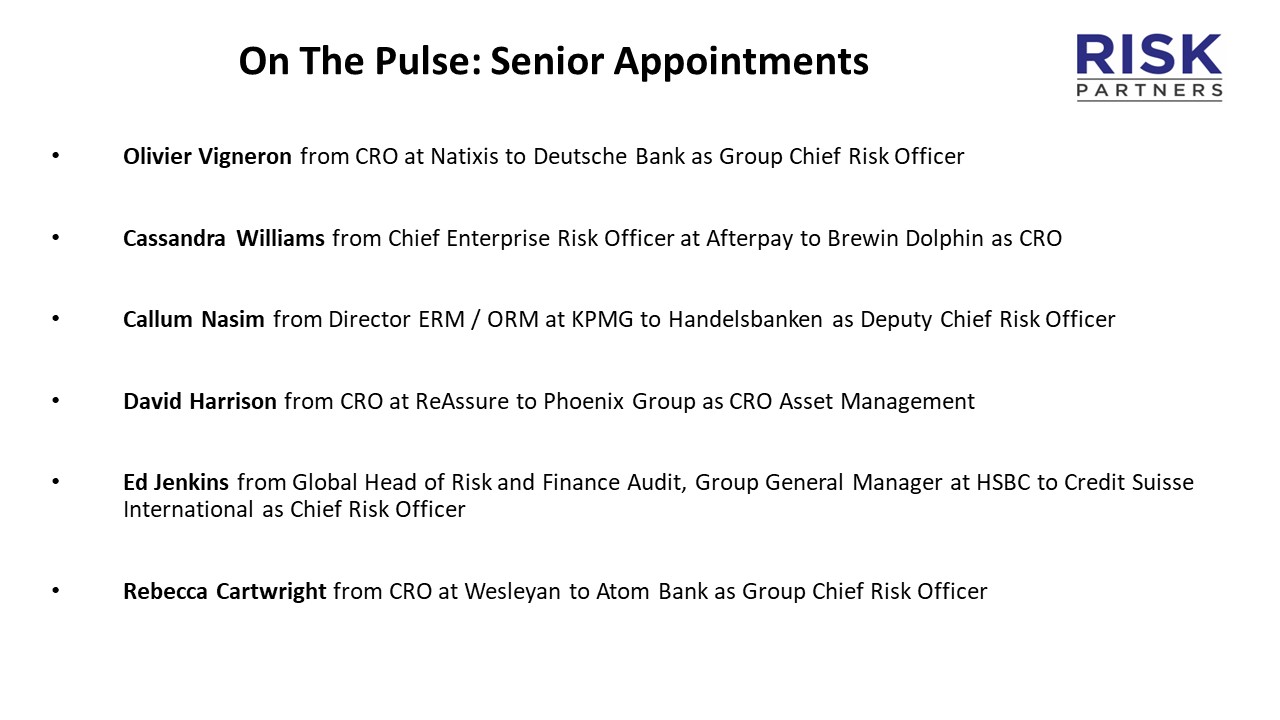

4. Fraud or misconduct: Banks can fail if they engage in fraudulent activities or other misconduct that erodes customer trust and results in significant financial losses. Banks now investment sizable sums of money in divisions such as Anti-Fraud, KYC teams (Know Your Customer) or AML (Anti-Money Laundering) to prevent this from happening.

5. Poor Governance: A subject close to our heart here at The Risk Partners! Banks can fail if they have poor Governance structures in place, such as weak Board oversight, inadequate risk management practices, or inadequate internal controls. If a firm is not policing its own activities, it can be a recipe for disaster.

6. Regulatory issues: Banks can fail if they fail to comply with regulatory requirements, such as capital adequacy and liquidity requirements, or if they engage in illegal or unethical practices. The rules of the game are established and can be viewed by anyone. Fall foul of the FED, PRA or EBA, significant penalties are coming your way!

In summary, Banks can fail for a variety of reasons and the above are just a selection.

Our job is to find your Financial Services business the talent required to stop your firm from falling into difficulties.

The Risk Partners are a boutique specialist recruiter, with Risk Management at its heart of its activities. We live in a world where Governance steers the world through often challenging times. Our aim is to work with clients to ensure that you find the right people for your business. Please get in touch to discuss how we can help you.